Table of Contents

- Can I Sell Stock Premarket Stock Trading Not Day Trading – One stop ...

- Premarket: 5 things to know before the bell

- Marketwatch Premarket

- Marketwatch Premarket

- Navigating the Stock Premarket: A Comprehensive Guide - Finviz

- Facts about premarket trading: Global Trading Software

- Can I Sell Stock Premarket Stock Trading Not Day Trading – One stop ...

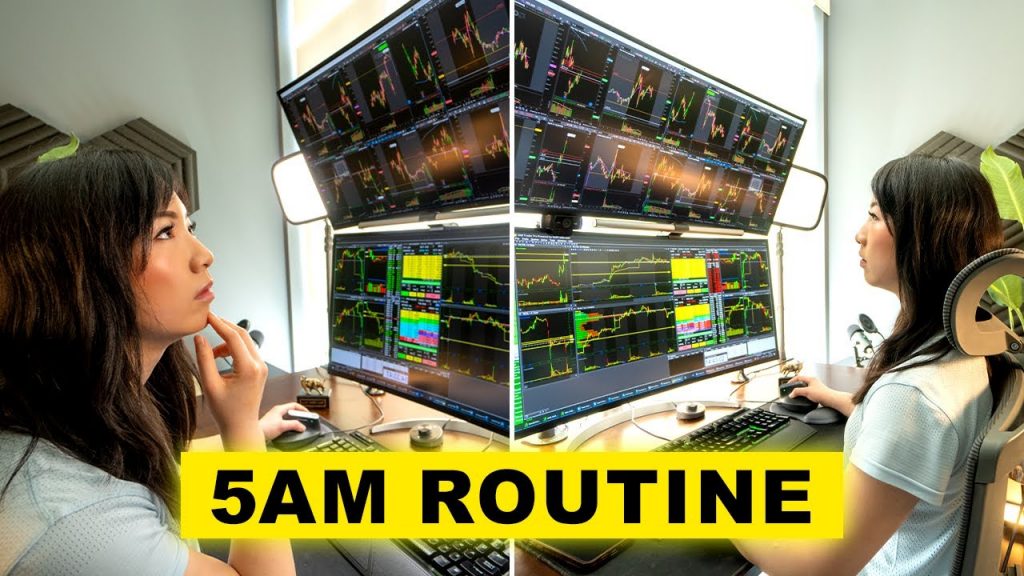

- Why Should You Consider Adding Premarket Trading to Your Strategy? | Al ...

- All about Premarket Trading and how to use in your trading - Stock ...

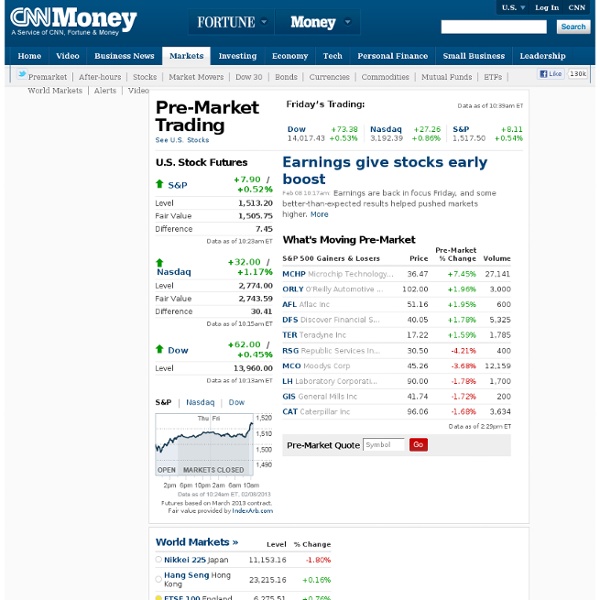

- Cnn Premarket - Image to u

For many investors, the traditional trading hours of 9:30 am to 4:00 pm ET are the only time to buy and sell stocks. However, with the advancement of technology and the rise of electronic trading platforms, investors can now participate in pre-market and after-hours trading. In this article, we will delve into the world of extended trading hours, exploring the benefits and risks of pre-market and after-hours trading, and providing insights on how to navigate these markets.

What is Pre-Market Trading?

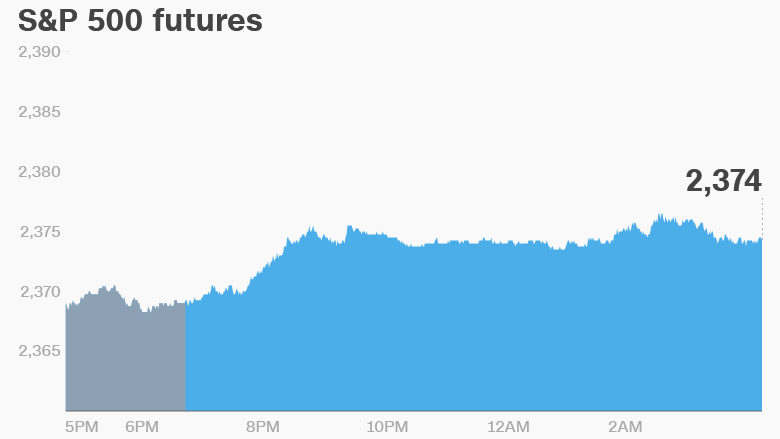

Pre-market trading, also known as early trading, takes place before the regular market hours, typically between 8:00 am and 9:30 am ET. During this period, investors can buy and sell stocks, but the trading volume is usually lower compared to regular hours. Pre-market trading allows investors to react to overnight news and events that may impact the market, such as earnings announcements, economic data releases, or geopolitical events.

What is After-Hours Trading?

After-hours trading, also known as extended hours trading, occurs after the regular market hours, typically between 4:00 pm and 8:00 pm ET. Similar to pre-market trading, the trading volume is lower, and the prices may not reflect the actual market value. After-hours trading allows investors to respond to news and events that occur after the regular market closes, such as earnings reports or unexpected announcements.

Benefits of Pre-Market and After-Hours Trading

Extended trading hours offer several benefits to investors, including:

- Increased flexibility: Investors can react to news and events outside of regular hours, allowing them to adjust their portfolios accordingly.

- Improved liquidity: Extended trading hours provide more opportunities for buyers and sellers to interact, potentially leading to better prices.

- Enhanced risk management: Investors can hedge their positions or adjust their strategies in response to overnight events, reducing potential losses.

Risks of Pre-Market and After-Hours Trading

While extended trading hours offer benefits, they also come with risks, including:

- Lower liquidity: Trading volumes are typically lower, which can result in wider bid-ask spreads and reduced market efficiency.

- Higher volatility: Prices can be more volatile due to the lower trading volume and lack of market participants.

- Less transparency: Quote and trade data may not be as readily available, making it difficult to assess market conditions.

Pre-market and after-hours trading offer investors the opportunity to react to news and events outside of regular market hours. While these extended trading hours provide benefits, such as increased flexibility and improved liquidity, they also come with risks, including lower liquidity and higher volatility. As with any investment strategy, it is essential to understand the risks and benefits before participating in pre-market and after-hours trading. By doing so, investors can unlock the secrets of extended trading hours and make informed decisions to achieve their investment goals.

For more information on pre-market and after-hours trading, visit Investopedia, a leading online resource for investors. With its comprehensive guides, tutorials, and news, Investopedia provides investors with the knowledge and tools needed to navigate the complex world of finance.