Table of Contents

- Irs 2024 W9 - Lelah Natasha

- Irs 2024 W9 - Lelah Natasha

- W9 2024 Fillable Irs - Ibbie Laverne

- Irs 2024 W9 - Lelah Natasha

- Free Fillable W 9 Form 2024 - Remotepc.com

- Irs 2024 W9 - Lelah Natasha

- Free Printable 2024 W 9 Form - Jodee Lynnell

- Irs 2024 W9 - Lelah Natasha

- Irs 2024 W9 - Lelah Natasha

- Irs 2024 W9 - Lelah Natasha

What is the Purpose of the IRS Form W9?

Who Needs to Fill Out the PDF IRS Form W9?

How to Fill Out the PDF IRS Form W9

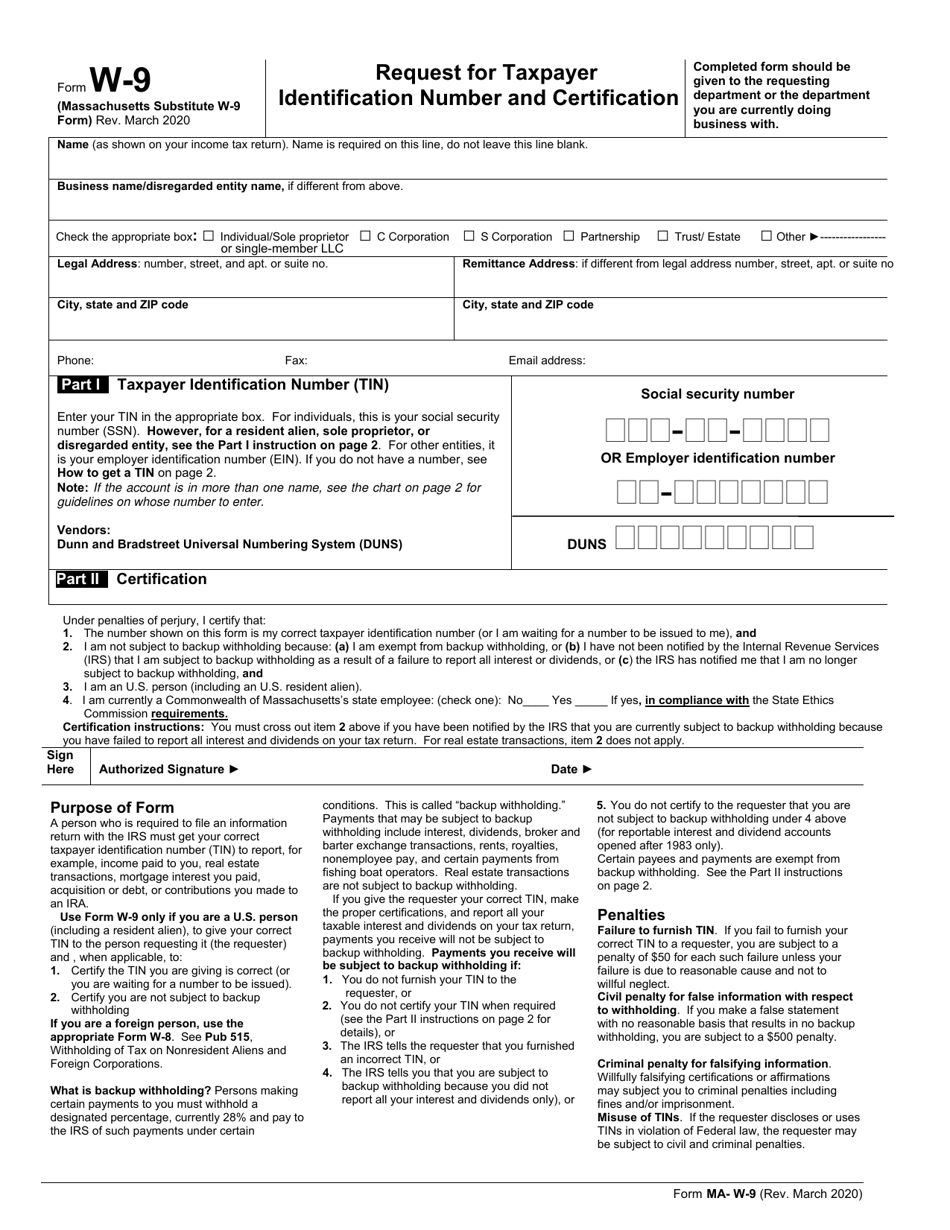

Filling out the PDF IRS Form W9 is a straightforward process. Here are the steps to follow: 1. Download the PDF version of the IRS Form W9 from the official IRS website. 2. Fill out the form electronically or print it out and fill it out by hand. 3. Provide your name, business name, and address. 4. Enter your taxpayer identification number (TIN), which can be either an EIN or an SSN. 5. Certify that you are not subject to backup withholding and are eligible to receive payments without tax withholding. 6. Sign and date the form.