Table of Contents

- Irmaa Brackets 2025 And 2026 - Marshall T Tipton

- Medicare Irmaa Brackets For 2025 Images References : - Isadora Blake

- 2025 Irmaa Brackets Based On 2025 Income Limit - Denna Tamarra

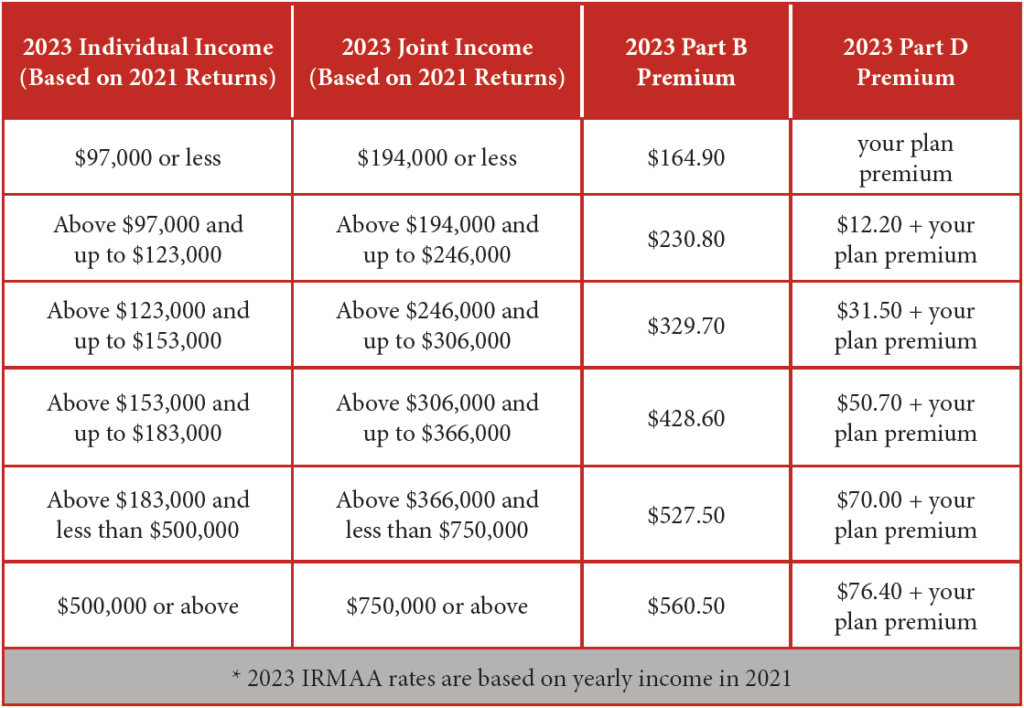

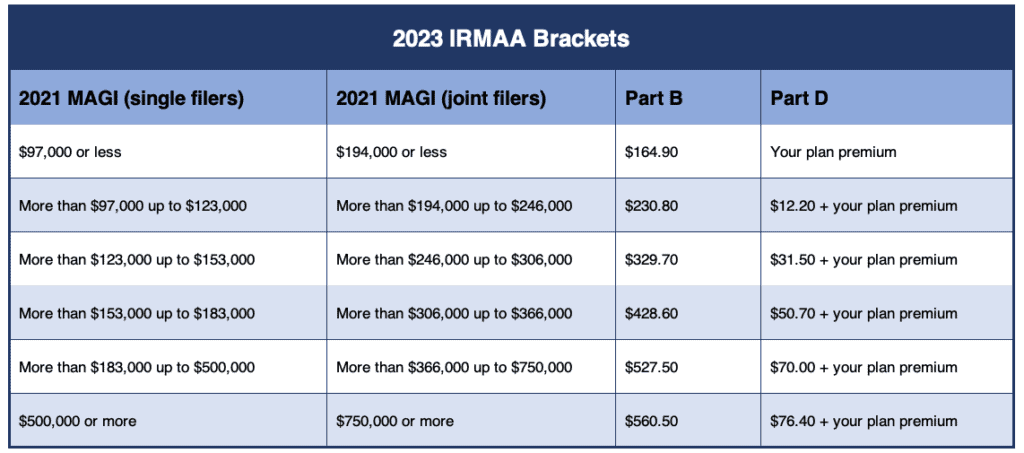

- The 2023 IRMAA Brackets - Social Security Intelligence

- 2025 Irmaa Brackets Based On 2025 Income Limit - Denna Tamarra

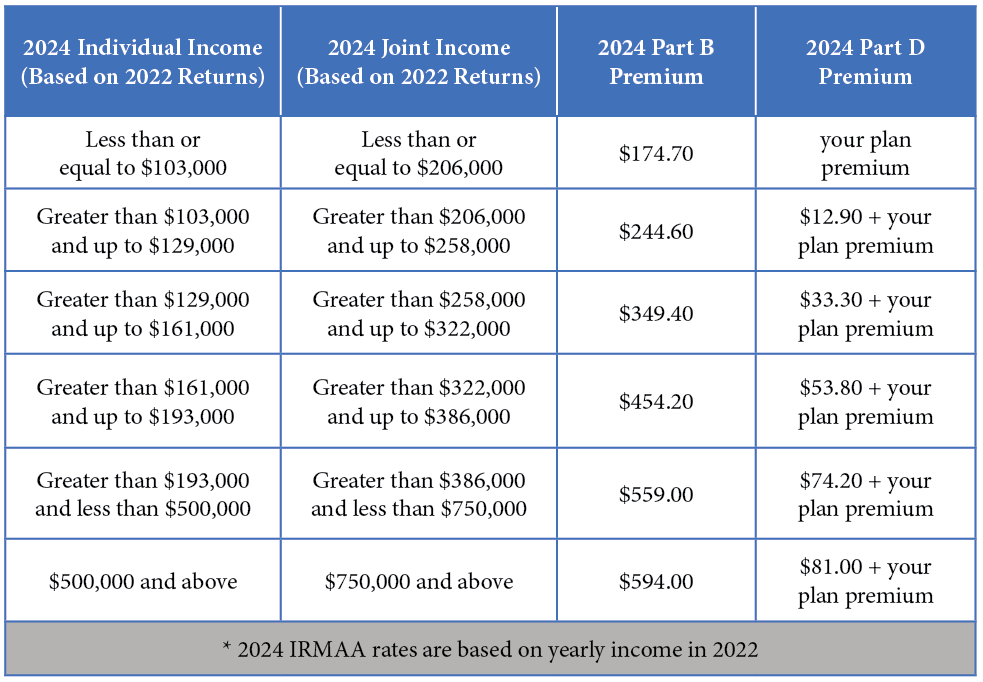

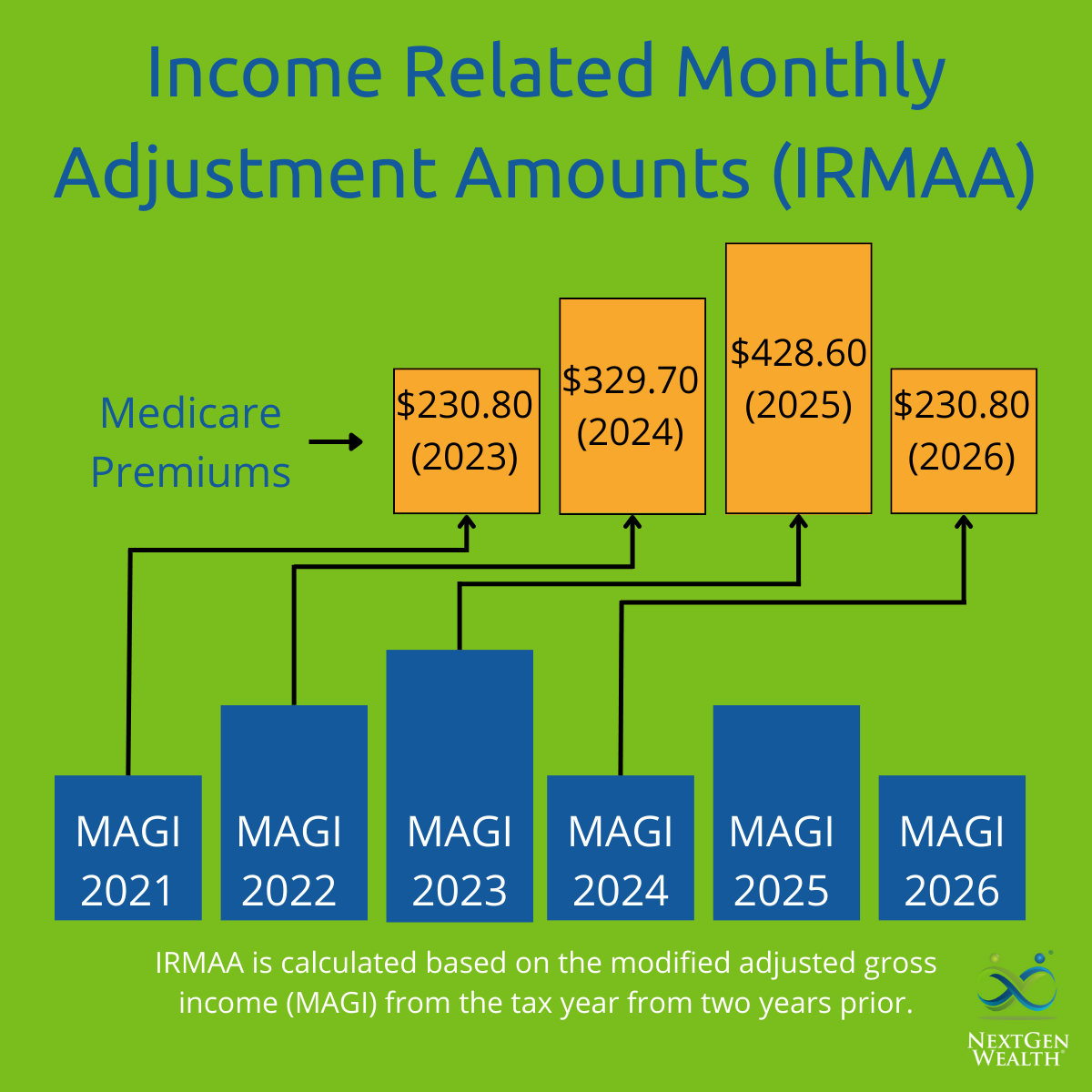

- Estimated 2025 IRMAA Brackets: Navigating The Income-Related Monthly ...

- Irmaa Brackets 2025 And 2026 - Marshall T Tipton

- Irmaa Brackets 2025 Chart - Angela Randall

- Irmaa Brackets 2025 And 2026 - Mufi Tabina

- 2025 Irmaa Brackets Based On 2025 Income Limit - Denna Tamarra

What is IRMAA?

PDF Income Brackets for IRMAA