Table of Contents

- Irs Pay Calendar - Zoe Lindie

- How to Make IRS Payments for Your Taxes - Tax Defense Network

- How to View Your IRS Tax Payments Online • Countless

- Internal Revenue Service (IRS) | Definition, How It Works, History

- IRS relaunches Get My Payment portal for 2nd coronavirus stimulus

- UPDATE: IRS Website To Make Payments Returns Late On Tax Day - WTAW ...

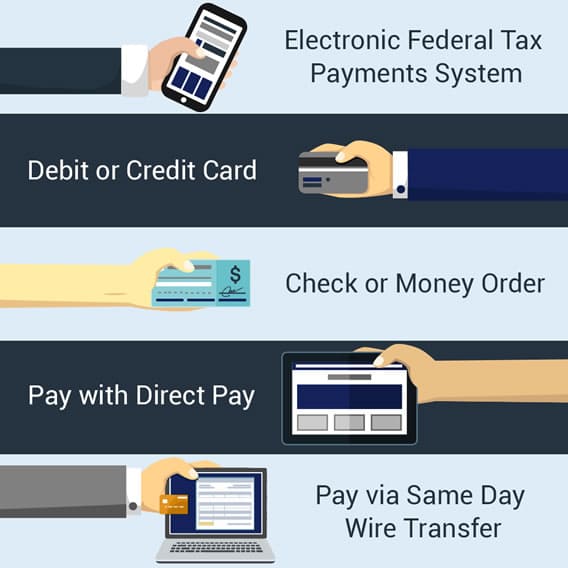

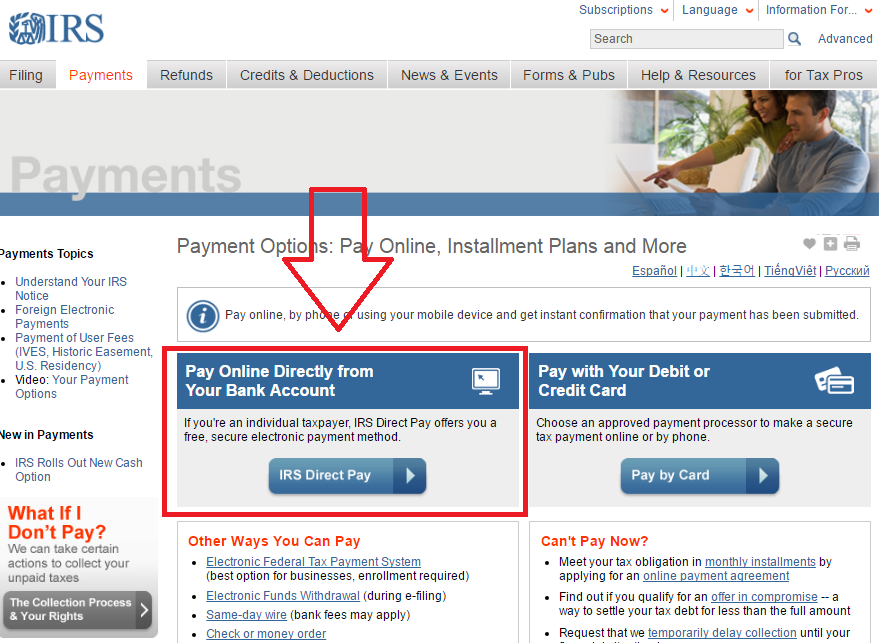

- IRS Payment Plans, Installments & Ways to Pay | E-file.com

- How to View Your IRS Tax Payments Online • Countless

- IRS, 1200달러 못받은 납세자위해 핫라인 개설 | SHADED COMMUNITY

- How to Pay Taxes for Side Hustles and Extra Income | Young Adult Money

Understanding Your Options

Eligibility Requirements

How to Set Up a Payment Plan

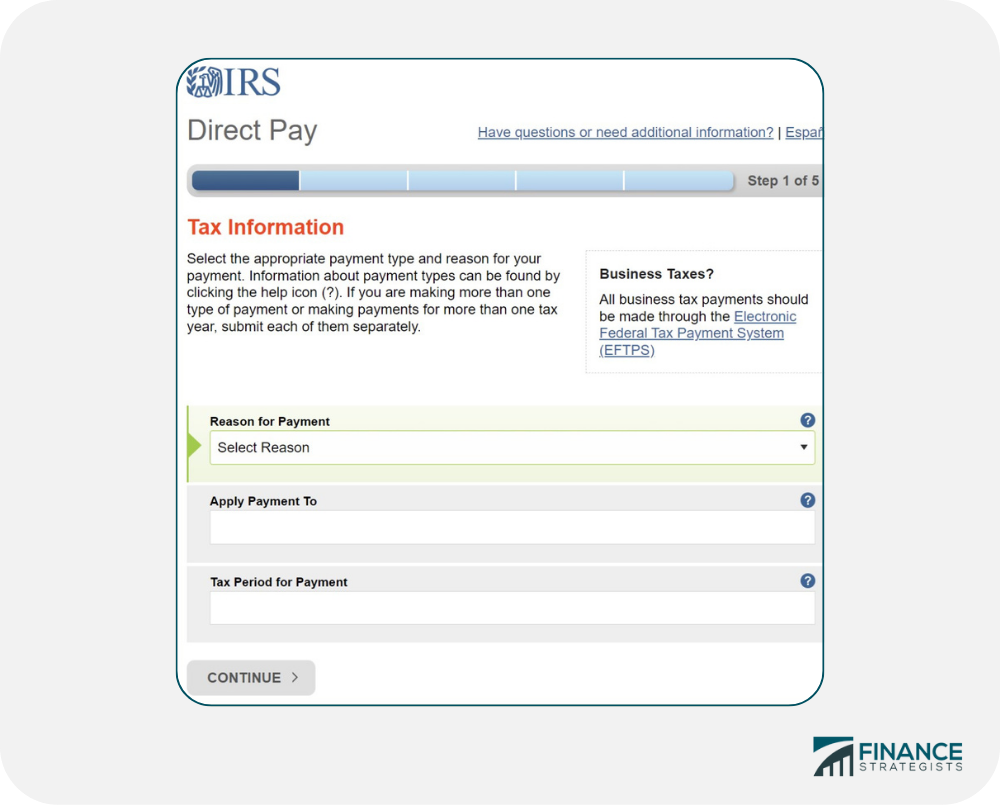

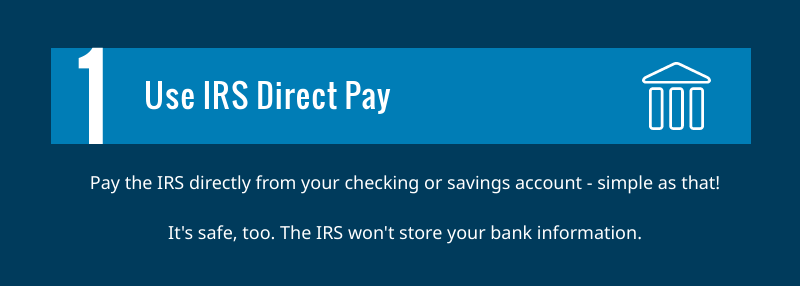

Setting up a payment plan with the IRS is a relatively straightforward process. Here are the steps to follow: 1. Gather required information: You'll need to provide your name, address, Social Security number or Individual Taxpayer Identification Number (ITIN), and the amount you owe. 2. Choose your payment method: You can pay by check, money order, credit card, or electronic funds withdrawal. 3. Apply online or by phone: You can apply for a payment plan online through the IRS website or by calling the IRS at 1-800-829-1040. 4. Make your first payment: Once your payment plan is approved, make your first payment to avoid additional penalties and interest.