Table of Contents

- Lvmh Moet Hennessy Louis Vu Se | semashow.com

- LVMH Moët Hennessy - Louis Vuitton (Tii:LVMHF) | TiiCKER

- Chia sẻ với hơn 73 về moët hennessy louis vuitton se mới nhất ...

- Is Lvmh Louis Vuitton | semashow.com

- Infografik LVMH Moët Hennessy – Louis Vuitton SE - Limes 8

- Luxury giant LVMH hits 400 billion euro in market value | Reuters

- Moet Hennessy Louis Vuitton

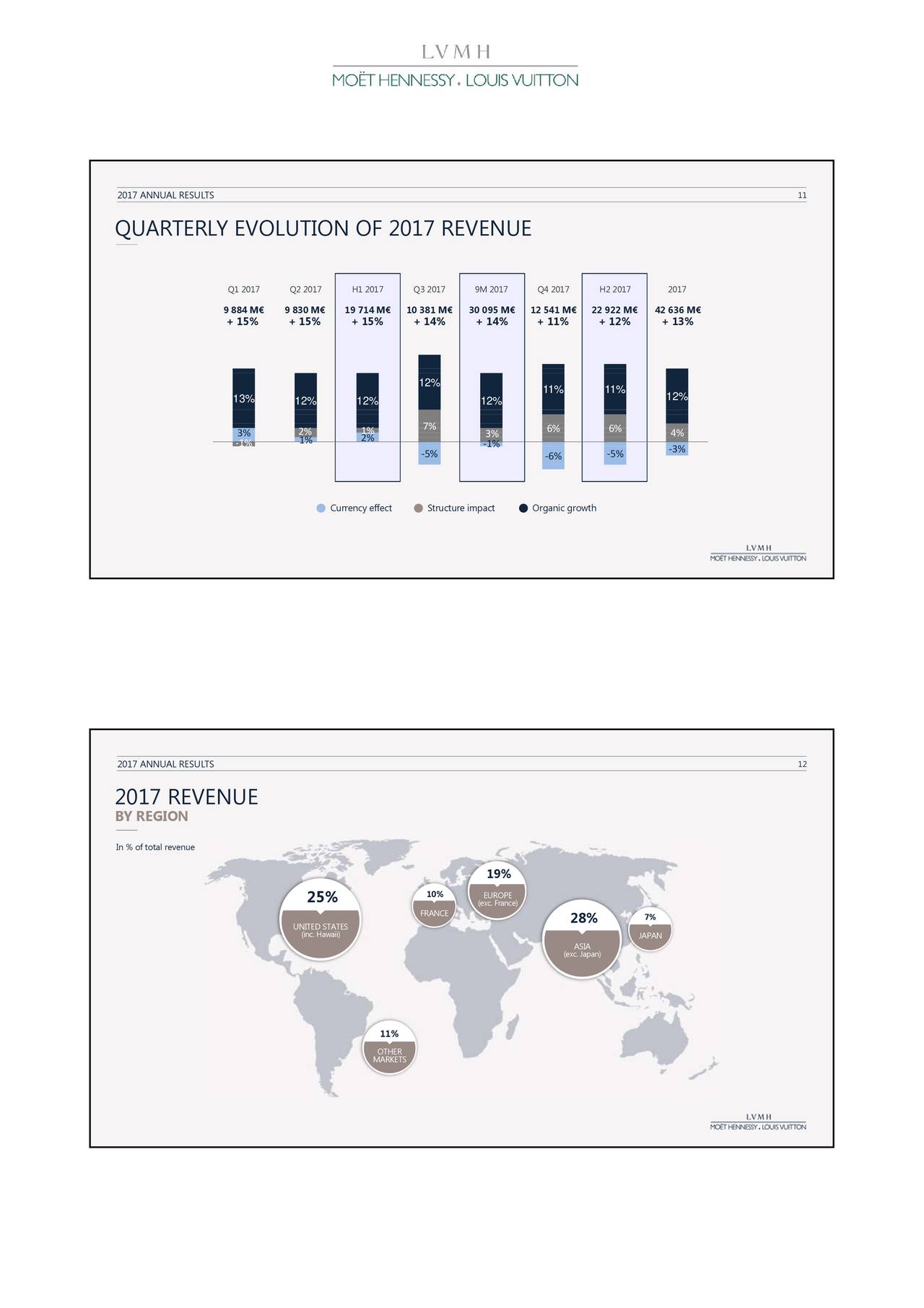

- Lvmh Moet Hennessy Louis Vuitton Annual Report 2017 | semashow.com

- Luxury giant LVMH hits 400 billion euro in market value | Reuters

- LVMH Moët Hennessy - Louis Vuitton (Tii:LVMHF) | TiiCKER

Reasons Behind the Decline

Impact on the Luxury Goods Industry

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PYVRK2CEWNKTFOHLMQ6HISPDPU.jpg)

Investors and analysts will be closely watching LVMH's next move, and the company's response to the decline in stock price will be crucial in determining its future success. One thing is certain, however: the luxury goods industry will continue to be a significant player in the global economy, and companies like LVMH will need to innovate and evolve to remain at the forefront of this industry.

As the luxury goods market continues to navigate these challenges, one thing is clear: the future of the industry will be shaped by the ability of companies like LVMH to adapt to changing consumer preferences and market trends. With the right strategy and a commitment to innovation, LVMH and other luxury goods companies can emerge from this challenging period stronger and more resilient than ever.