Table of Contents

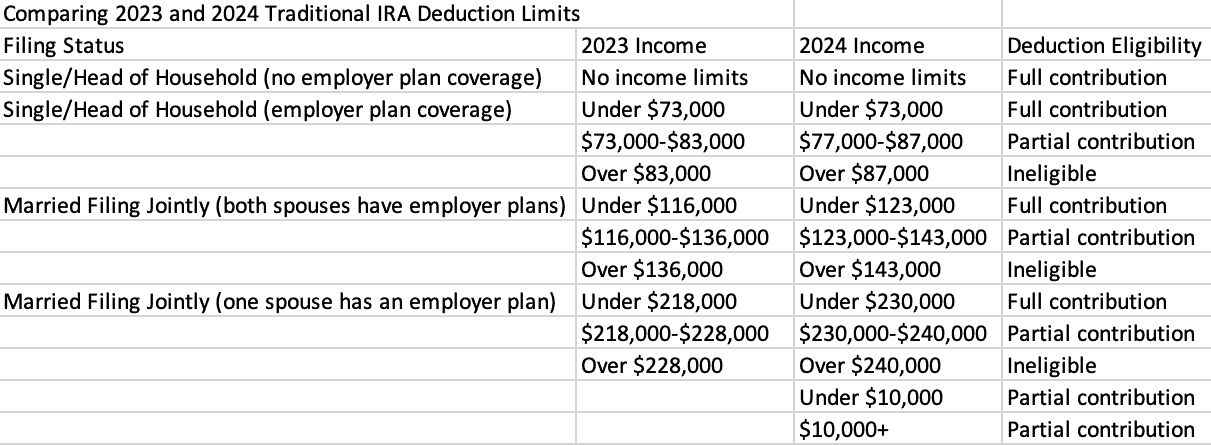

- 2024 401k and IRA Contribution Limits - Modern Wealth Management

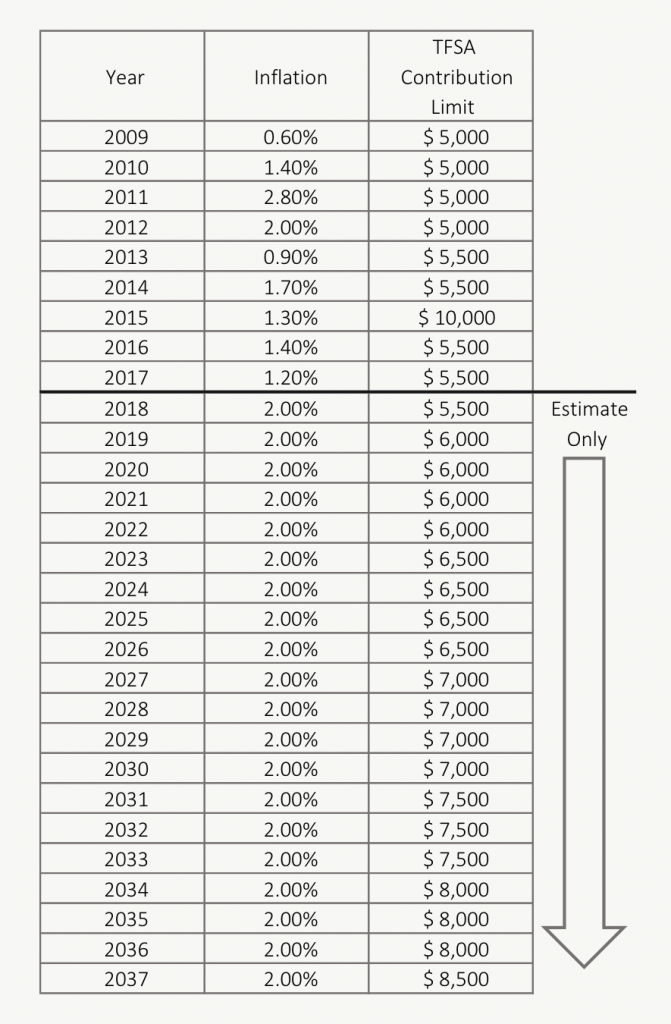

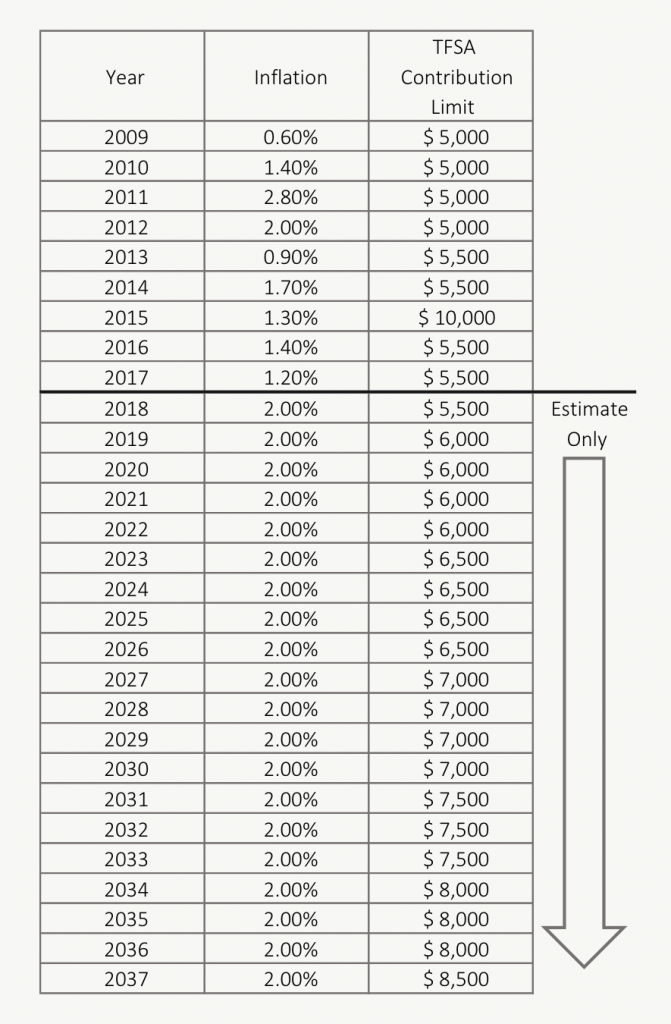

- TFSA Limit 2024: All about TFSA Contribution Limit for year 2024

- IRS Increases 401(k) Limit to ,000 for 2024, IRA Limit to ,000 ...

- Tax Rules 2024 - Lilla Patrice

- Irs Cola Limits 401k 2024 - Erinn Jacklyn

- Tfsa 2024 Contribution Limit - Deeyn Evelina

- Tfsa 2024 Contribution Limit - Deeyn Evelina

- Maximum Tfsa Contribution For 2024 - Sher Emiline

- TFSA Contribution Limit 2024

- Tax Changes You Should Know for 2024: 401(k) Limits, Tax Brackets and ...

Introduction to IRS Limits

2026 IRS Limits Forecast Highlights